- In predictably accelerating the uptake of BEV/PHEV and despite well-publicised refinements of public policy, the UK’s ZEV mandate and European CAFE regulation also predictably accelerate demand from the public charging network, which underlies return on investment.

- However, the established funding model of private investment in CPOs may be insufficient to raise the substantial capital required across both markets by 2030 and beyond.

- The uninspiring financial performance of most CPOs challenges their viability as stewards of investors’ capital. How can we change this?

This guest editor article was written by Alex Georgianna of Grace Automotive. Alex is a founder of Grace Automotive where he levers a background in finance & operations in the automotive & infrastructure sectors in supporting M&A and capital raises in the EV charging sector across the UK, Europe and North America. Prior to leaving Steer, where he founded their practice in the development and funding of EV charging infrastructure, Alex served as Senior Vice President of Avis Budget Group where he divested the firm’s European leasing operations to BNP Paribas to form Arval Leasing, acquired and consolidated Budget Rent a Car into Avis’ core operations, before then leading the turnaround of Budget’s failing Ryder Truck Rental subsidiary.

In Driving up EV Adoption, Regulation Predictably Accelerates Expanding Demand for Public Charging

With approximately 6.5% of cars and vans on UK roads now being fully-electric or plug-in hybrid, the UK’s public charging network continues to grow in supplying this expanding vehicle parc.

The UK now has over 85,000 public charging points, spread across nearly 45,000 locations. Thus far, the £1 billion-plus combined installation cost of these devices has been largely funded through direct equity investment in CPOs subsidized with public funding.

However, given mandated growth expected in the nation’s BEV and PHEV parc, this funding model may well prove insufficient in attracting the £5 billion of incremental investment required by 2030 – and the additional £5-£7 billion required by 2035.

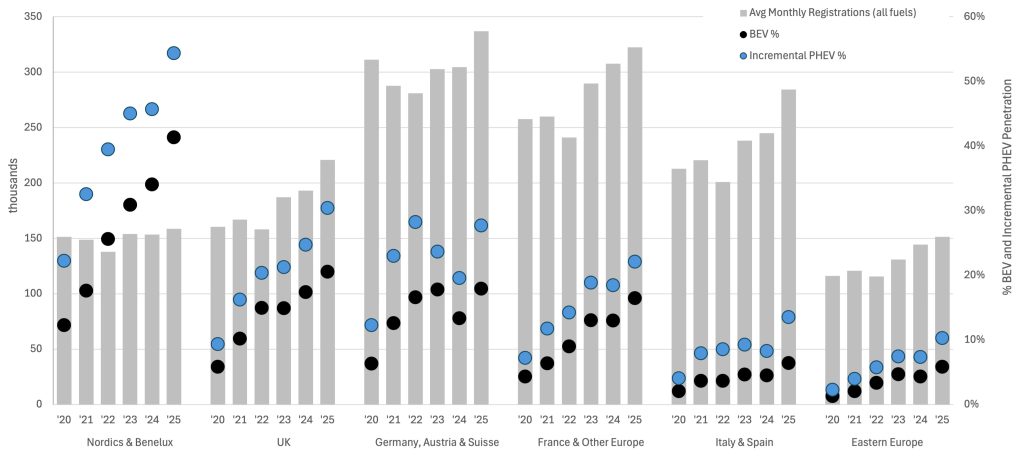

Across the UK and Europe, both the ZEV Mandate and CAFE regulations compel increasing the uptake of BEV/PHEV to an eventual ban on anything but zero emission cars and vans (effectively BEV only). As shown below, uptake is clearly responding to the regulations with uptake approaching or exceeding 30% of new car and van registrations across most Western European markets by 2025.

Adjustments to Mandates Maintain Predictability

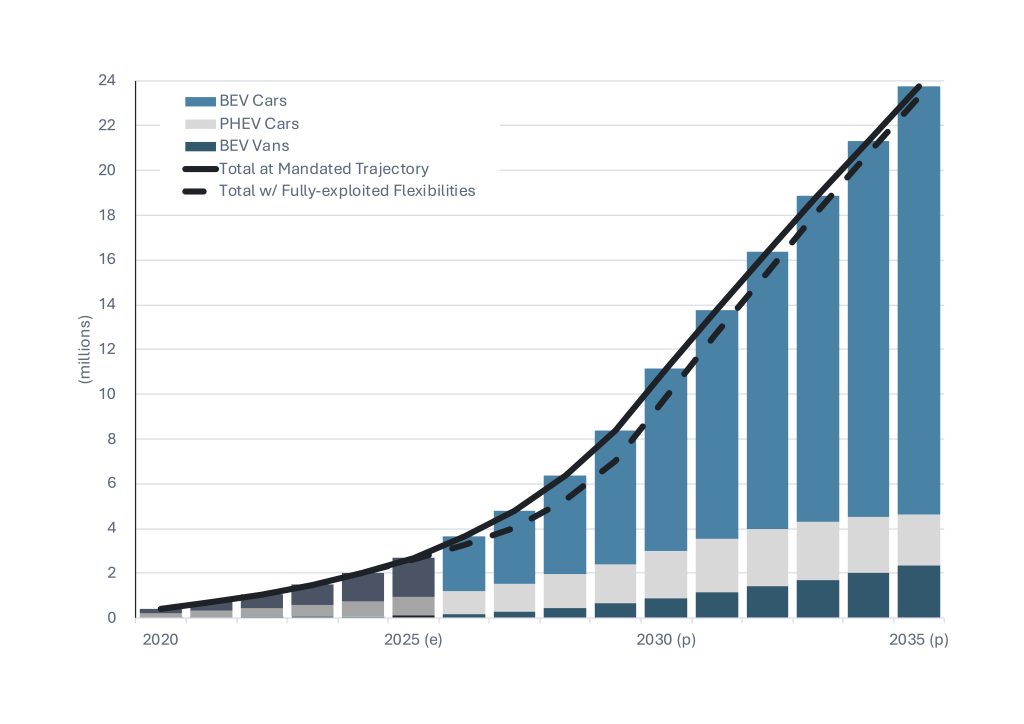

Earlier this year, the UK responded to stakeholder criticism of its ZEV regulation by expanding flexibilities to “ease” manufacturers’ compliance (largely by allowing limited borrowing against future “non-ZEV” allowances to cover current-year shortfalls). By enforcing repayment of accrued borrowing by 2030 the UK has preserved its commitment to a ZEV future while defining a predictable “low” case in BEV/PHEV adoption as illustrated by the dotted line below. Note the reconvergence of both projections as of 2035.

Here in late 2025, the battleground has shifted to Europe where the Commission has opened the door to greater flexibility around its CAFE regulation including expansion of CO2 emissions in newly registered cars and vans from 0% to no more than 10% of 2021 levels by 2035. The total scope of proposed adjustments is both complex and not yet finalised. However, like additional flexibilities in the ZEV Mandate, adoption of these adjustments to the CAFE regulation will only define a predictable “low” case for BEV/PHEV adoption across Europe rather than an abandonment of established policy.

Direct Investment in CPOs May Prove Ineffective in Raising Required Capital

While their development of the public charging network has not yet been constrained for lack of capital (and in fact, the table below reflects some notable largely UK-focused 2025 capital raises), lenders and more conservative institutional investors may increasingly resist stewardship of their capital by CPOs with arguably dubious viability.

| CPO | GBP (Millions) | Lendors/Investors |

| Zest | £60 Equity | Zouk |

| Energy Park | £35 Equity | Zouk |

| Char.gy | £35 Equity | Zouk |

| Be.EV | £55 Debt | Natwest and KfW-IPEX |

| Aegis Energy | £100 Equity | Quinbrook |

| Connected Kerb | £65 Equity | National Wealth Fund and Aviva |

| Believ | £300 Equity & Debt | Liberty Global, Zouk, MUFG, Natwest, Santander, and ABN AMRO |

| Osprey | £110 Debt | Novuna, Soc Gen, Aldermore, and NWF |

| GRIDSERVE | £100 Equity | TPG, Mitsubishi, and Infracapital |

| Hubber | £60 Equity | Bayliss and Fox |

| IONITY | £500 Debt | ABN Amro, BNP Paribas, and others |

| Fastned | £70 Debt | Retail Bonds |

| Allego | £150 Debt | Meridiam |

| Roam | £65 Debt | Natwest, NWF, and Triodos |

| Evyve | £15 Debt | Novuna |

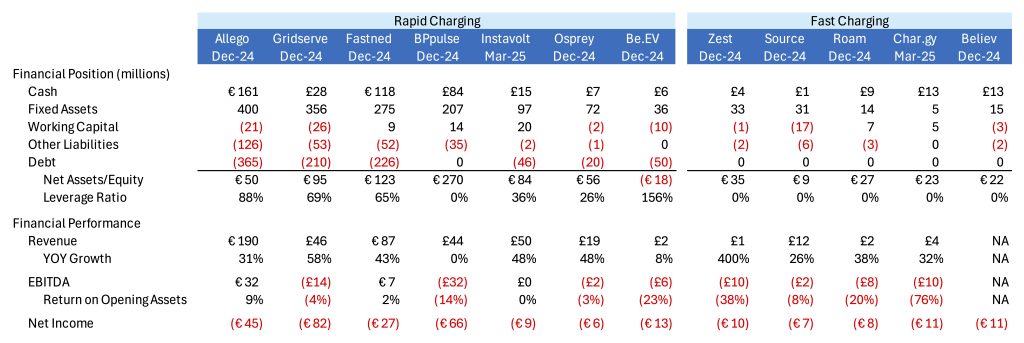

The table below illustrates the financial position of selected panels of rapid-charging and fast-charging focused CPOs.

Like the rest of the industry, none of these 11 ventures have accrued net income despite respectable revenue growth. In fact, only Allego and Fastned, both of whom predominantly serve the European market, recorded positive earnings before interest, taxes, depreciation, and amortization (EBITDA).

The rapid charging segment

Led by Allego (recently de-listed and now a subsidiary of Meridiam), Infracapital-backed Gridserve, Schroders-backed Fastned and BP Pulse, these seven CPOs demonstrate net investment in excess of £1.5 billion. With the exception of bp pulse (who can arguably fund investment however they like), each has attracted third party debt while only Allego and Fastned demonstrate positive EBITDA.

Of the three smaller businesses (including EQT-backed Instavolt and Osprey, backed by Investec and the UK’s National Wealth Fund), Be.EV actually demonstrates negative net assets on negligible revenue and particularly unprofitable operations.

The fast charging segment

Editor note: For the purposes of this article, Believ has been categorised under the fast charging segment, but the firm also operates public charge points across other charging speed segments.

Led by Zouk-backed Zest and TotalEnergies’ Source, these 5 ventures (including Denham Capital’s Roam, Zouk-backed Char.gy and Liberty/Zouk’s Believ) represent far lesser invested assets of just over £100 million – although recent progress in the UK’s LEVI subsidy program indicates substantial growth expected in the nation’s fast-charging network through 2026 and beyond. Also, all have yet to demonstrate positive EBITDA. Of the ventures, only Roam has announced its attraction of debt capital.

Going forward, it’s likely that new funding structures must emerge across the UK and Europe to attract capital at greater scale while separating commercial risk of the CPO from the real asset risk of the chargepoints themselves.

Conclusion

The investors that will ultimately fund development of the UK and Europe’s public EV charging network crave predictability in the emergence of demand that underlies return on investment. Fortunately, the legislative mandates that drive predictable growth in the BEV/PHEV parcs of the UK and Europe drive equally predictable growth in demand for public charging services even in the face of well-publicized enhanced flexibilities in public policy

However, the now rather standard funding model of direct investment in relatively risky CPOs may prove insufficient to attract the scale of investment required by 2030 and beyond.

Fortunately, like other similar industries, alternative and far more asset-focused structures are and will continue to emerge by which public rapid and fast charging providers may better attract investment to viable business models. The onus now burdens operators and investors to better define optimal funding models to attract investment to the anticipated pace of demand growth.